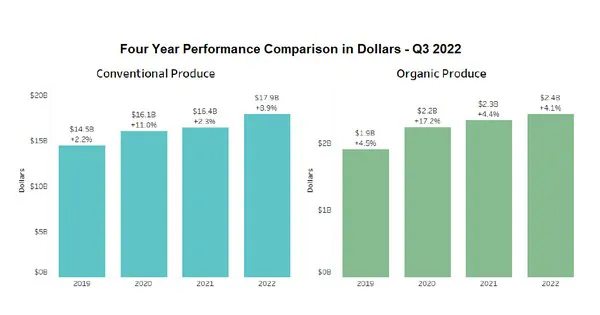

Ongoing inflation resulted in higher retail prices of organic fresh produce during the third quarter of 2022, generating a 4.1 percent increase in total organic dollars but also contributing to a decline of 4.5 percent in organic volume compared to the same period last year, according to the Q3 2022 Organic Produce Performance Report released by Organic Produce Network (OPN) and Category Partners.

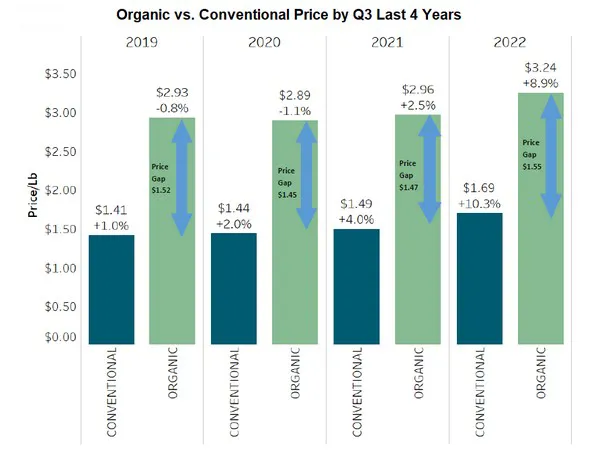

Organic fresh produce pricing per pound increased by 8.9 percent for Q3 2022 compared to the same period last year, with sales for the quarter topping $2.4 billion. At the same time, conventional produce's average price per pound increased by more than 10 percent, with total sales of $17.93 billion.

The report uses Nielsen IQ syndicated data to track and report the performance of organic fresh produce—and specifically the top 20 leading organic categories.

"Comparing the third quarter of this year to the third quarters of the past three years shows organic volume declining—and more than three percent higher than the decline in conventional produce volume for Q3 of 2022," said Tom Barnes, CEO of Category Partners. "Conventional produce outperformed organic produce in dollar growth, suggesting price increases in conventional produce have been more easily absorbed by consumers than the higher prices in organics."

"Comparing the third quarter of this year to the third quarters of the past three years shows organic volume declining—and more than three percent higher than the decline in conventional produce volume for Q3 of 2022," said Tom Barnes, CEO of Category Partners. "Conventional produce outperformed organic produce in dollar growth, suggesting price increases in conventional produce have been more easily absorbed by consumers than the higher prices in organics."

Organic apples and lettuce were examples of product substitution from organic to conventional by consumers as their price per pound of organic increased by more than double the amount of conventional.

A bright spot for organic sales in Q3 was the tomato category, which saw a 19 percent increase in volume and a 30 percent increase in dollars. In total, 14 of the top categories posted year-over-year increases in dollars, with potatoes, onions, and peaches showing double-digit gains. Conversely, apples posted the largest decline in dollar sales, with lettuce and bell peppers also showing noticeable declines.

Berries and packaged salads continue to be the top two organic produce categories, responsible for nearly 40 percent of all organic produce dollars.

Berries and packaged salads continue to be the top two organic produce categories, responsible for nearly 40 percent of all organic produce dollars.

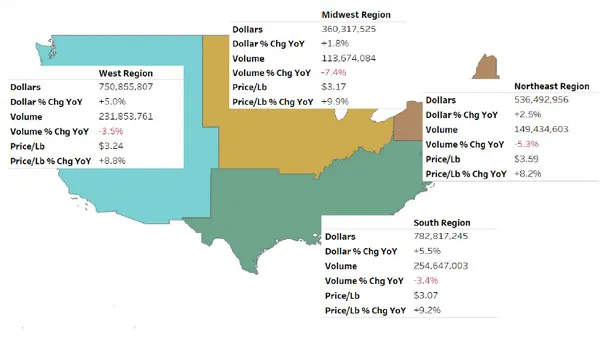

Geographically, all four regions of the U.S. showed consistent organic performance where dollars grew, and volume declined. The Midwest saw the lowest dollar growth (1.8 percent) and highest volume decline (–7.4 percent), and it was the region with the highest price per pound increase (9.9 percent). Consistent with previous reports, the South continued to show the most improvement in year-over-year increases in sales and decreases in volume for the quarter (5.5 percent).

The Q3 2022 Organic Produce Performance Report covers total food sales in the U.S., including all outlets (i.e., supermarkets, mass merchandisers, club stores, dollar stores, convenience stores, and military commissaries) over July, August, and September of this year. The full report is available on the Organic Produce Network website here.

The Q3 2022 Organic Produce Performance Report covers total food sales in the U.S., including all outlets (i.e., supermarkets, mass merchandisers, club stores, dollar stores, convenience stores, and military commissaries) over July, August, and September of this year. The full report is available on the Organic Produce Network website here.

For more information:

For more information:

Matt Seeley

Organic Produce Network

Tel: +1 (831) 884-5092

[email protected]

https://www.organicproducenetwork.com/