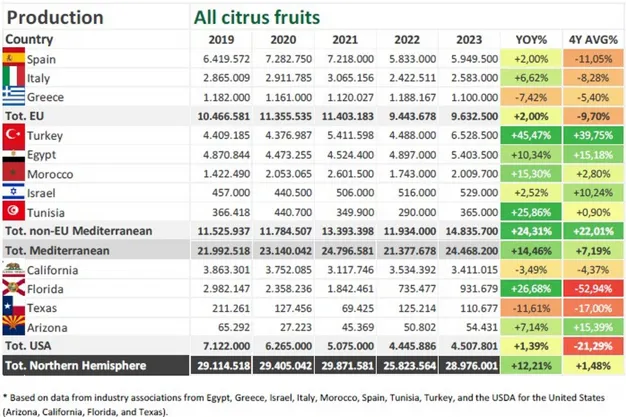

The World Citrus Organisation (WCO) released its annual Northern Hemisphere Citrus Forecast for the 2023-24 season. It was released after the Global Citrus Outlook conference organized on 15 November by WCO. The forecast is based on data from Egypt, Greece, Israel, Italy, Morocco, Spain, Tunisia, Turkey, and the United States. Citrus production is projected to reach 28,976,001 T, representing a 12.2% increase compared to the previous peak low season. The 2023/2024 forecast is 1.48% higher than the average of the last 4 seasons.

The preliminary forecast is based on data from industry associations from the Mediterranean region and the US. Total citrus exports are expected to follow a similar trend at 9,483,770 T, up by 11.4% from last season and 4.5% from the last four seasons’ average.

Philippe Binard, WCO Secretary General: “The market insights indicate a recovery from the low point of last season. The growth is mainly influenced by growth in Turkey and Egypt while other countries are stable or only recorded marginal gains”. Eric Imbert from CIRAD: “While this year's forecast shows a recovery with variable conditions across the producing countries and citrus categories, climatic issues, such as late frost, drought, heat waves, or new pests and diseases influenced the quality, colouring, or harvest date for the production. The market will still be impacted by geopolitical instability while consumer demand is under pressure due to limitation of purchasing power and inflation”.

Spain's citrus production at 5.9 MT is up by 2% with stable soft citrus compared to last year, fewer oranges (-6%) and more lemons. Italy increased by 6% at 2.6 MT, with more oranges (+20%) and less soft citrus and lemons (-10% each), while Greece is down by 7% to 1.1 MT.

In the other Mediterranean countries, Turkey is now the market leader with a first production estimate of 6.5 MT (+45%), with strong growth across all categories, it could even exceed 7 MT. This results from the increased acreage and productivity, alternance, and favourable climatic conditions. Egypt at 5.4 MT is up by 10% from the previous season and 15% from the average of the last 4 years. The main category is oranges with 3,7 MT (+5%) while soft citrus’s double-digit growth should almost reach 1.3 MT. Morocco’s production is expected to partially recover, bouncing back to just over 2 MT, with 1 MT of soft citrus (+11%) and 930,000 T of oranges. Israel’s production is estimated at 365,000 T, but the recent conflict and attack on the country is a source of multiple challenges regarding supply, logistics, and human resources for harvesting and packing.

The production in the United States will be up by 1% at 4.5 MT with more oranges (+10% at 2.4 MT) but less soft citrus (-2% at 856,000 T) and even less so for lemon ( -12% at 889,000 T).

World Citrus Organisation

Email: [email protected]

www.worldcitrusorganisation.org