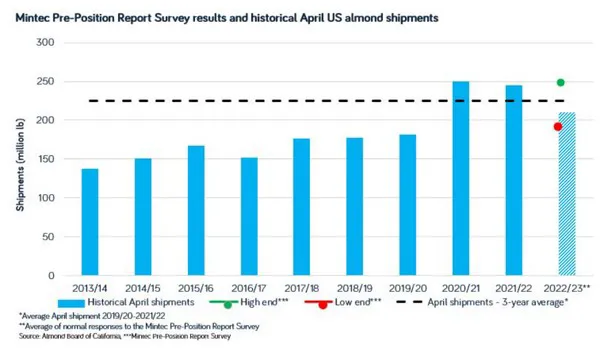

Market participants surveyed by Mintec in the first week of May were expecting lacklustre shipments and new sales ahead of the April position report, which is due for release on 11th May. Estimates for April almond shipments were reported in the range of 190-240 million pounds, with most market participants returning figures of 200-220 million pounds.

“It isn’t much of a surprise that industry is expecting lower shipments. Sellers have been reluctant to engage over the past several months in the face of lower 2023 production and buyers have been happy to work down stocks unless the price from origin is right. If we reach 200 million pounds, I’d say it puts us in a fairly good position moving forward,” a US exporter disclosed to Mintec.

Based on the current inventory levels from the March position report, an average shipment number of 210 million pounds in the remaining months of the season (April-July) would put ending stocks close the 700 million pounds. To reduce ending stocks to 600 million pounds, an average of 230 million pounds would have to be shipped each month.

USDA and Land IQ release almond acreage reports

The USDA and Land IQ acreage reports, which were release on 27th April, pegged the bearing acres for the 2023 crop at 1.38 million acres and 1.37 million acres respectively. The initial Land IQ estimate forecast a removals figure of 77,714 acres, 29% higher than the year prior and 49% higher than the three-year average.

“I think that the actual bearing acreage is likely to be lower than the initial reports as there are a lot of acres that have been abandoned which still look from the outside to be bearing acres. The situation on the ground is going to deviate more from the official figures than in previous years as a result,” a US handler said to Mintec.

Both reports came in lower than the area multiplier used in the Terra Nova Trading (TNT) production estimate of 2.29 billion pounds which was released the week prior. The adjusted production figures using the TNT yield of 1650 lb/acre stand at 2.27 billion pounds (USDA area adjusted) and 2.25 billion pounds (Land IQ area adjusted).

The Land IQ final release will provide an updated look at removals and bearing acreage and is due for release in November 2023.

For more information:

Mintec

Nuts@Mintecglobal.com

mintecglobal.com