Brazilian fresh fruit exports set a record in 2021, both in terms of volume and revenue, exceeding US$ 1.21 billion, up 20.39% from the value of exports in the twelve months of 2020. The total volume of fresh fruit shipped abroad was 1.24 million tonnes, 18.13% more than the previous year’s same period.

Among the fruits most exported by Brazil in 2021 are mangoes, with US$ 248 million, corresponding to 20% of the total exported in the year; melons, with US$ 165 million, representing 14%; grapes, with US$ 155.9 million and 13%; nuts and chestnuts, with US$ 151.9 million and 13%; lemons and limes, with US$ 123.8 million and a 10% share.

Exports of Brazilian fruits in 2021 were mainly destined for the European Union (48%), the United States (16%), the United Kingdom (14%), Argentina (4%), and Canada (3%).

According to data from Brazil’s foreign trade secretariat, Brazil exported 614 thousand tonnes of fresh fruits this year (from January to September), down 16.7% from the same period in 2021.

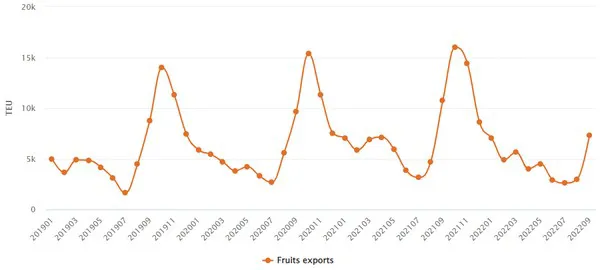

See below the track record of Brazilian fresh fruit exports in containers from January 2019 to September 2022. The data is from DataLiner.

Fresh fruit exports | Jan 2019 – Sep 2022 | TEUs

As for revenue, almost US$ 585.5 million were collected, a decrease of 16.1%. Although the last months of the year are traditionally intense in terms of shipments of important fruits for the Brazilian export basket (such as mangoes, melons, watermelons, and grapes), the sector does not expect a full recovery from the lower performance recorded so far.

“Many factors explain [the poorer performance] this year, including the protest of Federal Revenue auditors, which created obstacles in strategic areas for the sector. I believe the fresh fruit market will grow next year, particularly if we take action to strengthen the market,” said Pizzamiglio.

Several factors hampered the 2022 scenario, including the war, in which the economic embargo imposed by several countries on Russia (due to the invasion of Ukraine) resulted in surplus fruit production in traditional buyers in Brazil, such as the European Union. Furthermore, the war increased fertilizer prices, raising production costs in Brazil and limiting the competitiveness of some fruits.

The logistical constraint was another aggravating factor; the lack of ships and containers and high freight rates (sea and road) limited business opportunities in 2022. The price of most fruits was not readjusted in the same proportion as the advance verified for costs, resulting in lower margins. The exchange rate is also restricting the exporter’s profitability in 2022.

“Furthermore, the end of the year was marked by currency volatility, which raises concerns among Brazilian fruit producers. We’ll have to keep an eye on how the foreign market reacts, especially given the increased tensions in Europe’s military conflict,” the executive concludes.

Source: www.datamarnews.com