It is clear that the underlying costs for operating liner services has increased significantly over the past couple of years. The important question is how much these costs have actually increased. This provides one of the anchor points in assessing what the baseline rate level might settle at once we get through the present rate renormalization.

While it would be ideal for analyzing costs across multiple carriers, few carriers provide detailed cost data. We have looked at the cost data published by Hapag-Lloyd, which publishes this type of data with the most granularity, on a systematic basis, and with several years of history. The underlying assumption is thus that Hapag-Lloyd is representative of the market.

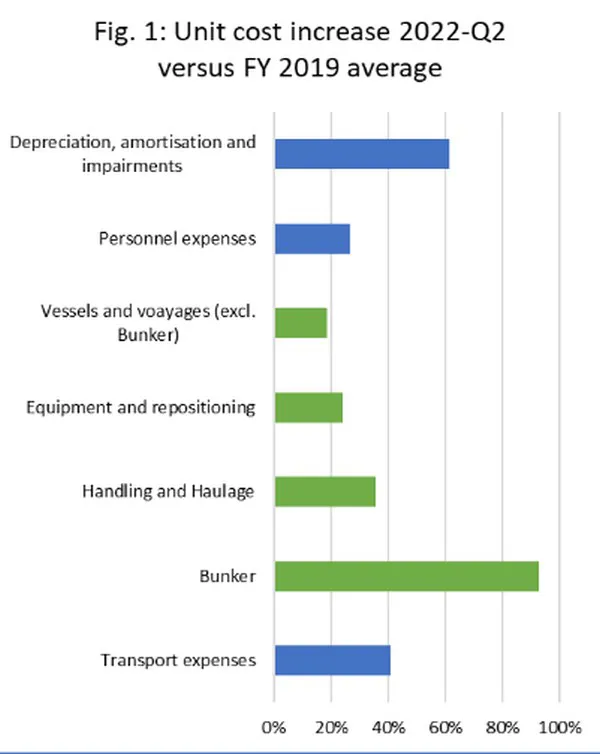

Hapag-Lloyd has three major cost categories – transport expenses, personnel expenses, and depreciation, amortization, & impairments. Transport expenses are subdivided into bunker, handling & haulage, equipment & repositioning, vessels & voyages (excl. bunker), and expenses for pending voyages (an exceedingly small element and will not be analyzed here).

Figure 1 shows a comparative overview of the increases in each of these cost elements. The unit cost is calculated across transported volumes in that quarter. The blue bars are the three main cost categories, and the green bars are the subcomponents of transport expenses.

Bunker costs are here seen to have experienced the largest relative cost increase compared to 2019. When we account for the relative share, the cost increase in handling and haulage is accountable for 37% of the unit cost increase, followed by bunker fuel which is accountable for 30% of the cost increase.

This means that two-thirds of the inflationary pressure is related to fuel, handling, and haulage. This is also a key pointer as to where the carriers are likely to focus in the months ahead, as the ongoing market downturn will force carriers to focus on cost reductions.

For more information:

Sea-Intelligence ApS

Vermlandsgade 51

2300 Copenhagen S - Denmark

info@sea-intelligence.com