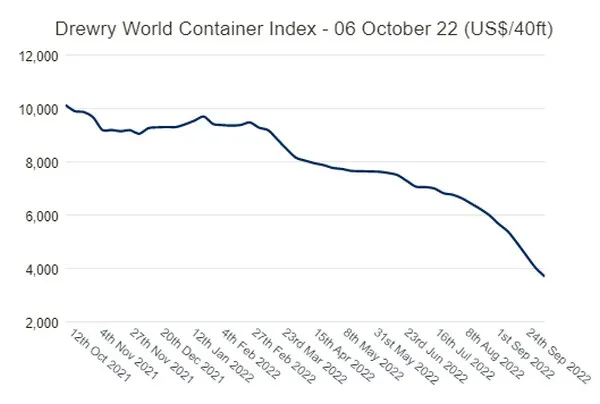

The losses for the Drewry's World Container Index (WCI) keep stretching. The Index lost 8% to end at US$3,688.75 for the week, extending its weekly-loss streak to 32 weeks. The Index has now lost 76% of its gains since the pre-pandemic levels.

Source: Drewry Supply Chain Advisors

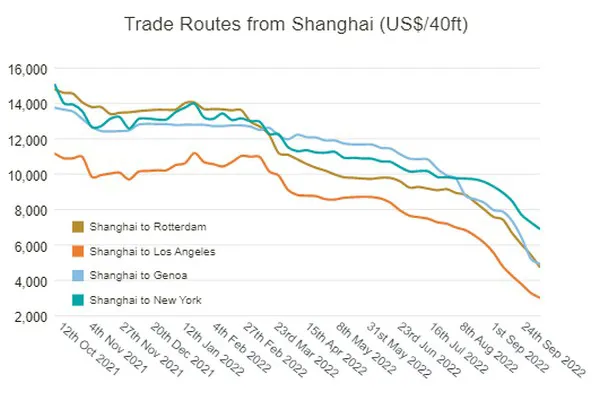

Source: Drewry Supply Chain Advisors

An often oversighted trade lane, the Rotterdam-Shanghai saw its spot prices dip to three digits for the first time since May 2020, depicting a quote of US$967. The US-Europe trade which is affected by congestion across both US and Europe, saw yet another stretch of weekly gains, even as the Europe-US trade lane recorded its highest ever quote of US$7,252. The US-Europe trade lane too recorded a high of US$1,305, in line with its counterpart.

Source: Drewry Supply Chain Advisors

Source: Drewry Supply Chain Advisors

As the Europe-US trade lanes have logged annual gains of 17% in spot rates, rates on China-US, China-Europe stretches have fallen anywhere between 55-75%. The Shanghai-Los Angeles (USWC) trade lane fell below US$3,000, a feat after 26 months, given the demand weakness and the Chinese golden week.

Drewry has published its assessment across the following eight major East-West trades:

For more information: container-news.com