Shippers might finally be catching a break, as China-US spot freight rates plunge in the first week of October. With Chinese manufacturers throttling production due to the power crisis and the off-season coming into view, competition for freight capacity in terms of containers and vessel space has fallen off, moving prices down by up to 51.4 percent on some routes.

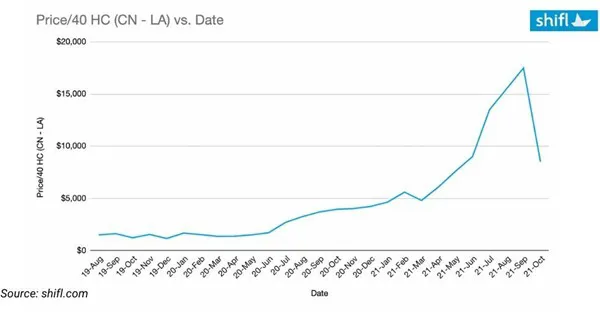

Data provided by digital freight forwarding company Shifl shows that the spot rate for shipping a 40-foot container from China to Los Angeles dropped by $9,000, or 51.4 percent between September and October of this year, from a high of $17,500 to $8,500.

Development of shipping rates from China to Los Angeles.

Development of shipping rates from China to Los Angeles.

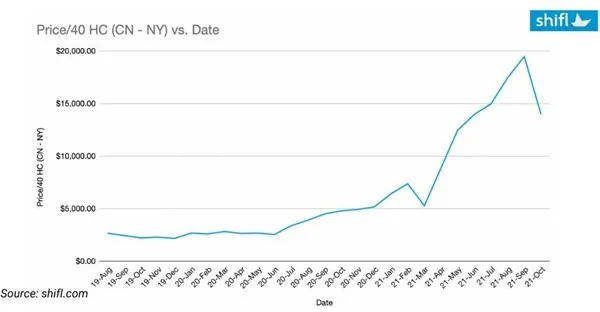

For China-US East Coast shipping, rates dropped by 28.2 percent in one month, down to $14,000 per container in October from $19,500 in September.

Development of shipping rates from China to the US East Coast.

Development of shipping rates from China to the US East Coast.

Temporary relief?

However, this temporary reprieve could soon be overshadowed by a growing backlog of unfulfilled orders. Chinese energy rationing policies and the impact of COVID-19 shutdowns are throttling factory output meaning that US and EU manufacturing orders are not being filled on time. While US and EU businesses scramble to diversify their supply chains, inventory shortages and price increases will become more pronounced.

“Before the pandemic, our customers were getting containers shipped for around $1,500,” said Shabsie Levy, Founder, and CEO of Shifl. “Some agents (co loaders) took advantage of the price increases and congestion by buying up capacity, and now they are looking to unload it as quickly as possible,” he added. “For shippers with inventory still in China, access to capacity at lower rates is great news. But the big question now is whether or not there will be products to fill these containers. These rates could go even lower. We’re already seeing long-term rates for shipping 40-foot containers from China to the U.S. go below $5,000,” added Levy. “ Contact:

Contact:

Charlie Pesti

Shifl

[email protected]

https://shifl.com