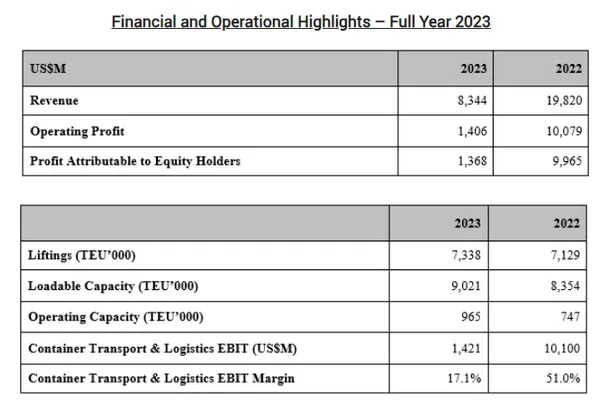

Orient Overseas (International) Limited has announced a profit attributable to equity holders of US$1,367.9 million for 2023, compared to a profit of US$9,965.2 million in 2022.

Earnings per ordinary share in 2023 was US$2.07, whereas earnings per ordinary share in 2022 was US$15.09.

The Board of Directors has recommended that the dividend for full year 2023 is approximately 50% of the profit attributable to equity holders at approximately US$687 million, with proposed payment of a final dividend of US$0.145 per ordinary share and a second special dividend of US$0.036 per ordinary share for 2023.

In order to optimise the capital structure of the Company and reflect our determination to reward the shareholders, the Board of Directors recommends the revision of the Dividend Policy so as to have a target annual dividend payout of 30% to 50% of the consolidated net profit attributed to the shareholders of the Company in the financial years of 2024, 2025 and 2026, whether as interim and/or final dividends, subject to, inter alia, the financial performance, liquidity position, future plans and working capital requirements of the Company and the prevailing economic, financial, business and regulatory circumstances.

The exceptionally robust container shipping market that we witnessed during the pandemic is now far behind us, and we have returned to a rather normal yet uncertain year 2023. The cargo demand recovery was not as strong as many anticipated, affected by high inflation, slowdown in economic growth of advanced economies, as well as the consumer spending patterns shifting in the post-pandemic. As carriers' schedule became more reliable, retailers opted towards a just-in-time approach when restocking, thereby delaying demand to a certain extent. On the supply side, with the alleviation of bottlenecks, and the continuous delivery of new ships, the change in supply has undoubtedly exceeded in demand and the continuous decline of freight rates.

So far, we have taken delivery of 7 newly built 24,188 TEU container ships. The delivery of these new ships will not only help to increase the capacity and also realise the Group's endeavours to modernise its fleet from a technology and configuration standpoint, improving its cost-effectiveness and market competitiveness, help the Dual-Brand achieve the goal of maintaining its world's first echelon status and is also another proof of OOIL's commitment in energy conservation, carbon reduction, and environmental protection.

Cooperation with fellow members of the COSCO SHIPPING Group and alliances helps to further expand OOIL's network, strengthen cost management capabilities, and contribute to the Group in increasing revenue and reducing expenditure. We believe the advantages of Dual Brand will continue to beneficial to the Group's future development.

For more information:

Kalia Wong

Orient Overseas (International) Limited

Tel: (852) 2833-3654

Email: [email protected]