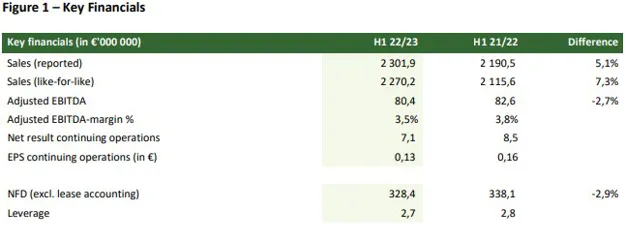

Greenyard achieved a 7.3% increase in sales (on a like-for-like basis) driven by +9,0% price increases in an inflationary environment (including € +16,6m FX impact on the USD, GBP and CZK). This is partially compensated by a limited decline in volume in the Fresh segment retail business with consumption rebalancing in the post COVID period. Group reported sales increased year-on-year by € 111,4m, up from € 2 190,5m to € 2 301,9m.

Greenyard achieved a 7.3% increase in sales (on a like-for-like basis) driven by +9,0% price increases in an inflationary environment (including € +16,6m FX impact on the USD, GBP and CZK). This is partially compensated by a limited decline in volume in the Fresh segment retail business with consumption rebalancing in the post COVID period. Group reported sales increased year-on-year by € 111,4m, up from € 2 190,5m to € 2 301,9m.

Adjusted EBITDA. Despite the unprecedented economic turmoil with the highest inflation in decades, supply chain disruptions and a period of drought, Greenyard managed to keep the absolute Adjusted EBITDA approximately stable (-2,7%) at € 80,4m as compared to € 82,6m last year. The Adjusted EBITDA margin slightly decreased from 3,8% in the same period last year to 3,5% for the first six months of the financial year.

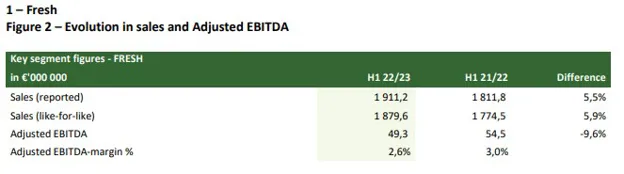

The Fresh segment achieved a sales growth of 5,9% on a like-for-like basis (or 5,5% on a reported basis), generating an additional €105,1m in sales in the first six months of the financial year. The sales increase was mainly attributable to +8,9% sales price increases on fruit & vegetables, compensated by a limited negative volume effect of -3,0% mainly attributable to a revived out of home consumption post-COVID. This limited decline in volume underlines Greenyard’s robustness when compared to the market’s 10% consumption drop in Europe in fresh produce. The integrated customer relationships continue to represent 74% of sales of the Fresh segment and provide a stable financial basis for the business.

The Adjusted EBITDA decreased by € -5,2m over the same period in the previous year, or down -9,6%, resulting in a margin decrease of -43bps as the accelerating inflation of input costs could not be fully translated into sales price increases given the current high price pressure within retail and declining consumption.

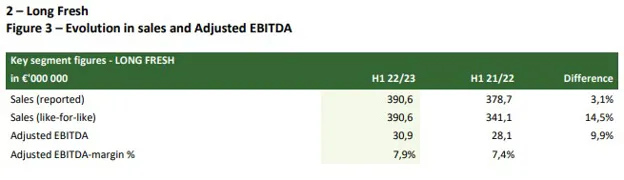

Sales in the Long Fresh segment have increased by € 49,5m compared with the same period last year, a 14,5% increase on a like-for-like basis (or 3,1% on a reported basis). The double-digit growth is explained by an increase of +5,4% in volume with food service and industry returning back to the pre-COVID level. The volume growth is the result of growth with both established and new customers. 9,1% of the sales growth is explained by sales price increases to cover inflation affecting all cost categories i.e. energy, packaging, transport, produce and labour.

The Adjusted EBITDA increased from € 28,1m to € 30,9m by 9,9% versus the same period last year. The increase shows the impact of the volume growth and was achieved despite certain production inefficiencies caused by lower crop yields due to drought and scarcity of labour. It also includes a significant one-off recovery of previous years’ contributions related to water management. The Adjusted EBITDA margin improved by 49bps to the level of 7,9%, which is also impacted by the divestment of Greenyard Prepared Netherlands in August last year which operated at lower margins.

Co-CEO Hein Deprez said: “The current economic circumstances have led the average per capita consumption to remain well below the WHO minimum recommendations of 400gr/capita/day. Today, we truly have an exceptional momentum to unleash the full power of fruit and vegetables. Favourable policy drivers and strategies are being rolled out, highlighting the essential role of the most healthy and sustainable food category. And at the same time, we see that fruit and vegetables have a minimal impact on purchasing power. In the consumers’ food baskets, the inflationary impact on these products has been lagging. Even more than before, now is the time to increase consumption of fruit and vegetables, to the benefit of people and planet.”

Co-CEO Marc Zwaaneveld added: “These are unprecedented times. We are living the global consequences of macro-economic and geopolitical turmoil, which is affecting economies, supply chains and businesses across the globe. Despite the pressure on businesses, Greenyard has shown the ability to leverage its strong, central position in the food value chain. In the current circumstances, we notice an increased appetite in our unique and integrated ways of working. With a strengthened relative market position and unaffected profitability, Greenyard is set to reap the benefits both of increasing consumption and its unique approach to the market, as soon as the economic and geopolitical climate comes to a new normal.”

For the full report, please click here.

For more information:

Cedric Pauwels

Greenyard

Tel: +32 15 32 42 00

Email: cedric.pauwels@greenyard.group

www.greenyard.group