AgroFresh Solutions, Inc., a global AgTech innovator providing a range of solutions, digital technologies and services to enhance the quality and extend the shelf life of fresh produce, today announced its financial results for the third quarter ended September 30, 2022.

“The third quarter marks the beginning of our Northern Hemisphere season. We posted third quarter operational2 revenue growth of 3.1% on a constant currency basis, despite weather related events in North America that impacted crop size and delayed the harvest season," commented Clint Lewis, Chief Executive Officer.

"As has been noted by numerous companies with international market exposure, foreign currency has also become a significant headwind given the continued strengthening of the U.S. dollar versus other currencies. For AgroFresh, the impact of foreign exchange is material given that almost 80 percent of our business is transacted outside of the U.S. For example, the EMEA region comprises approximately 50% of our revenues and this is particularly significant in the second half of the year. Despite the impact of foreign exchange, we continue to advance our diversification strategy. We achieved growth of nearly 13% in our reported revenues from diversification categories on a trailing-twelve-month basis, which represented our seventh consecutive quarter of double-digit increases on that basis, and now reflects nearly 45% of our trailing-twelve-month revenue mix."

Mr. Lewis added, “Regardless of weather-related or macro-economic obstacles, our team remains laser focused on delivering solutions to ensure our customers can provide a consistent supply of high quality fresh produce.”

Financial Highlights for the Third Quarter of 2022

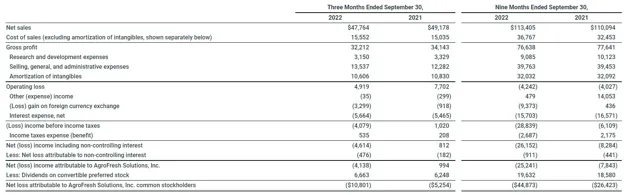

Net sales for the third quarter of 2022 decreased 2.9% to $47.8 million, compared to $49.2 million in the third quarter of 2021. Excluding foreign currency translation impacts, which reduced revenue by $3.0 million as compared to the third quarter of 2021, revenue increased 3.1%, primarily driven by leveraging a portfolio of diverse solutions. The SmartFresh diversification category was driven by the early timing of sales in EMEA, while North America experienced later timing of sales, which was partially offset by strong demand for EthylBloc amid the recovering flower industry. SmartFresh for Apple experienced growth in EMEA, Latin America, and APAC, which was partially offset by the unfavorable conditions affecting the North American season.

Gross profit for the third quarter of 2022 was $32.2 million, compared to $34.1 million in the prior year period. Excluding foreign currency translation impacts, which reduced gross profit by $3.0 million as compared to the third quarter of 2021, gross profit increased 3.1%. Gross profit margin was 67.4% as compared to 69.4% in the prior year period. The lower gross margin primarily reflects the Company’s strategic transition to a more diversified product portfolio, unfavorable foreign currency translation, and higher material costs associated with inflationary pressures, partially offset by select price increases.

Research and development costs were $3.2 million in the third quarter of 2022, compared to $3.3 million in the prior year period, due primarily to the timing of projects.

Selling, general and administrative expenses were $13.5 million in the third quarter of 2022, as compared to $12.3 million in the prior year period, with the increase driven primarily by commercial investment.

Third quarter 2022 net loss was $4.6 million, compared to net income of $0.8 million in the prior year period.

Adjusted EBITDA1 was $17.9 million in the third quarter of 2022, a decrease of $2.5 million, as compared to $20.5 million in the prior year period. The decrease in Adjusted EBITDA was primarily due to lower gross profit. As of September 30, 2022, cash and cash equivalents were $35.6 million.

Financial highlights for the first nine months of 2022

Net sales for the nine months ended September 30, 2022 increased 3.0% to $113.4 million, compared to $110.1 million in the nine months ended September 30, 2021. Excluding foreign currency translation impacts, which reduced revenue by $5.6 million as compared to the nine months ended September 30, 2021, revenue increased 8.1%, primarily driven by leveraging a portfolio of diverse solutions. Each of the Company's diversification categories generated growth in the nine months ended September 30, 2022, led by Antimicrobials and Coatings market penetration and expansion in EMEA. SmartFresh Diversification and EthylBloc contributed to growth in the Other 1-MCP category. This was partially offset by SmartFresh for Apple declines in certain countries in Latin America and North America due to unfavorable weather and timing events.

Gross profit for the nine months ended September 30, 2022 decreased to $76.6 million, as compared to $77.6 million in the prior year period. Excluding foreign currency translation impacts, which reduced gross profit by $2.2 million as compared to the prior year-to-date period, gross profit increased 1.6%. Gross profit margin was 67.6% as compared to 70.5% in the prior year period. The lower gross margin primarily reflects the Company’s strategic transition to a more diversified product portfolio, unfavorable foreign currency translation, and higher material costs associated with inflationary pressures, partially offset by price increases.

Research and development costs were $9.1 million in the nine months ended September 30, 2022, compared to $10.1 million in the prior year period, due primarily to the timing of projects.

Selling, general and administrative expenses increased 0.8% to $39.8 million in the nine months ended September 30, 2022, as compared to $39.5 million in the prior year period.

For the nine months ended September 30, 2022 net loss was $26.2 million, compared to net loss of $8.3 million in the prior year period. During the nine months ended September 30, 2021, the Company recorded $14.1 million of other income which related primarily to the receipt of proceeds from the settlement of a litigation matter.

Adjusted EBITDA1 was $35.3 million in the nine months ended September 30, 2022, a decrease of 0.7%, as compared to $35.6 million in the prior year period. The decrease in Adjusted EBITDA was primarily due to lower gross profit, which was negatively impacted by changes in foreign currency as compared to the prior year period.

Adjusted EBITDA was $61.8 million for the trailing twelve month period ended September 30, 2022, representing an Adjusted EBITDA margin of 36.5% for the trailing twelve month period ended September 30, 2022. Adjusted EBITDA was $59.3 million for the trailing twelve month period ended September 30, 2021.

Source: Globenewswire