A USDA report was released, stating the current situation with various fruits and vegetables cultivated in the European Union.

Apples

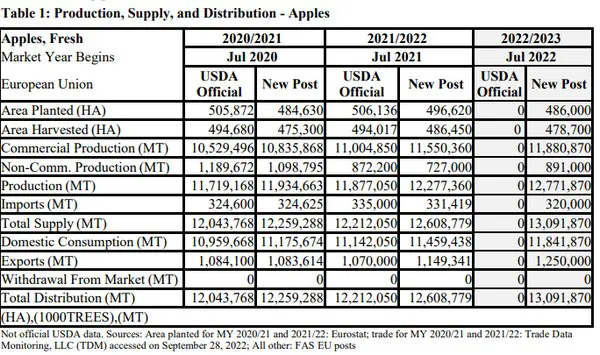

Commercial apple production in Marketing Year (MY) 2022/23 (July/June) is forecast at 11,880,870 MT an increase of 2.9% compared to the previous year and 7% compared to the average of the previous ten years. While growing conditions differed between the regions, high temperatures and drought were a common theme throughout most of the EU. In some countries this may result in smaller fruit size which in turn would lower final production numbers below the above stated estimate as smaller fruit weighs less.

Additionally, a lack of seasonal harvest workers and high energy costs may prompt farmers to leave some of their orchards unharvested. Quality is expected to be good, as hail and frost damage remained very localized. Market prospects are mixed. Beginning stocks were very low for both fresh apples and concentrated apple juice. The latter is important as the processing sector absorbs significant amounts of low-quality apples. However, per-capita fresh consumption is expected to be under pressure in MY 2022/23 as inflation and high energy prices will leave consumers with less disposable income for food. Since 2014, U.S. apple exports to the EU are low due to technical issues linked to using morpholine as an additive in waxes, and diphenylamine (DPA) – a post-harvest treatment for storage scald.

The EU is a competitor for U.S. apple exports in markets like Saudi Arabia, the United Arab Emirates (UAE), and India.

Pears

MY 2022/23 (July/June) EU commercial pear production is forecast at 1,987,958 MT, an increase of 14% compared to MY 2021/22 when pear production was down due to a record low harvest in Italy. Italy, followed by the Netherlands, Belgium, Spain, and Portugal, continues to lead pear production in the EU. This year’s growing season started out as a normal growing season but was followed by an exceptionally high number of very warm and sunny days during the spring and summer. Due to the abundance of sun this growing season, the sugar content of pears grown in the EU is high, meaning that the harvest has an excellent taste. Because of the drought, EU pears are expected to be (somewhat) smaller while the keeping quality could be negatively impacted. Picking started about two weeks earlier this season.

For MY 2022/23 EU pear imports could be somewhat down and exports up due to the increased commercial production numbers for pears. If the keeping quality is good, relatively more EU pears are expected to end up on the EU fresh consumer market this Marketing Year. The impact of measures taken to combat the pandemic on international pear trade is not expected to have an impact in MY 2022/23. To date Brexit has not impacted EU pear trade. EU pear exports to Belarus and Ukraine dropped during the months of February, March, and April 2022, but picked up in May and June 2022, more information about the Belarusian embargo can be found in the Policy section.

Table Grapes

In MY 2022/23 (June/May), EU table grape commercial production is forecast up 11.5% from the previous season. This is mostly due to volume increases in Italy, made possible by ideal temperatures in May and June that favored fruit setting. Production increases are also forecast in France and Spain.

Conversely, decreased volumes are forecast in Romania, Bulgaria, and Greece due to unfavorable weather. Overall, fruit quality is forecast to be excellent with higher sugar content due to hot temperatures in July, August, and early September. EU table grape imports from the United States are marginal. EU table grape exports to the United States are small.

Impact of Russia’s Invasion in Ukraine

By far the biggest impact on EU markets for fresh deciduous fruit in MY 2021/22 and for MY 2022/23 comes from direct and indirect effects of Russia’s invasion of Ukraine. Direct effects include the lack of seasonal workers from Ukraine (especially in Poland). Indirect effects are even more important and include increased production costs, due to increased prices for inputs such as plant protection products, fuel, and fertilizers. The increased electricity costs will translate into considerably higher storage costs.

Additionally, the price-surge of all commodities affects consumption in the EU as well as demand in important export destinations. With high inflation and lower disposable income consumers often spend less on fruit. Furthermore, countries in Northern Africa that imported much of their cereal grains from Ukraine would now rather use precious international currency to import wheat and corn, rather than fruit.

Higher transportation costs and reduced availability of containers add to the negative effects on trade. Against this backdrop, effects on direct trade of deciduous fruit between Ukraine and the EU are of less importance.

For the full USDA report, please click here.