Ocean Network Express (ONE) has announced improved financial results during the third quarter of the year (second quarter of the company's financial year) amid a container volume drop, compared to the figures in the same period last year.

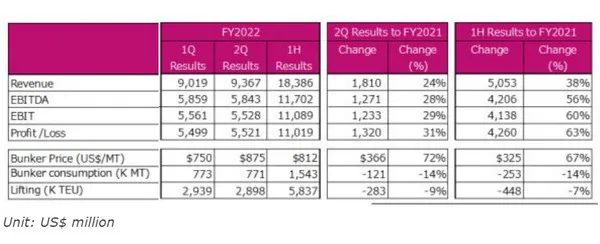

In particular, for the July-September period, the Singapore-headquartered shipping company achieved a 31% increase in its profit, surpassing US$5.5 billion, and a 24% growth in its revenue, exceeding US$9.3 billion. Additionally, ONE reported 28% and 29% increases in EBITDA and EBIT, respectively, reaching US$5.8 billion and US$5.5 billion.

In the same period, the global carrier moved fewer containers, reporting 2.9 million TEUs, translating to a 9% decrease compared with the same period in 2021. ONE said that there was a steady cargo movement in July, but a sudden decline in transport demand during August and September.

Despite the ongoing deterioration in market conditions, freight rates remained higher throughout the quarter than the same period last year, supporting profit figures, noted the company.

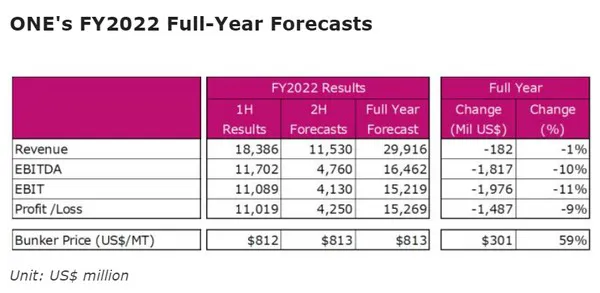

However, ONE said that full-year results for FY2022 (April 2021 - March 2022) are expected to show a profit after tax of US$15.26 billion, which represents a decrease from the previous year of around US$1.5 billion, reflecting declining demand and the deteriorating freight market.

"Ongoing supply chain disruptions and rising inflation are increasing costs, particularly in cargo handling and inland transportation," noted the company, adding that, "due to the inventory build-up situation in North America and Europe's entry into recession, it is expected to take some time for cargo movements and short-term freight rates to recover."

"Ongoing supply chain disruptions and rising inflation are increasing costs, particularly in cargo handling and inland transportation," noted the company, adding that, "due to the inventory build-up situation in North America and Europe's entry into recession, it is expected to take some time for cargo movements and short-term freight rates to recover."

For more information: container-news.com