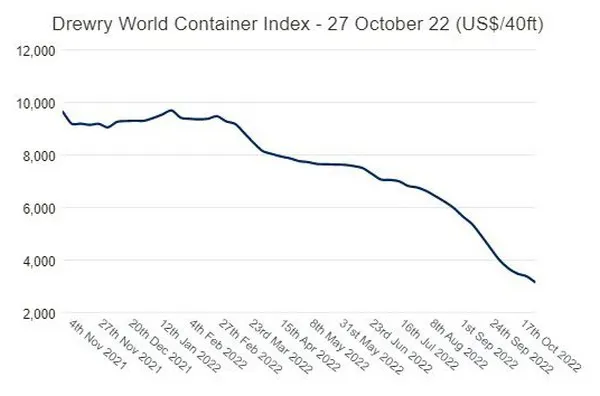

The Drewry’s World Container Index took a 7% tumble to quote at US$3,145. The Index which has lost 67% annually and 70% since its peak, has now retraced over 81% of its gains ever since the pandemic hit the globe.

After a series of double-digit percentage weekly losses, the magnitude of fall was reduced since the start of October. However, the 7% dip in the week was its greatest, in percentage terms, over the month.

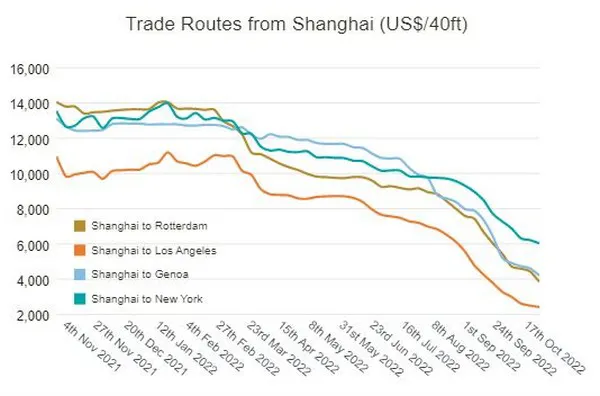

The rates on the Shanghai-Rotterdam stretch dipped 13% for this week while the Shanghai-Los Angeles trade route saw prices dipping further to US$2,412, having shed over 81% from its peak of US$12,424 witnessed in September 2021.

The current spot rates on the trade route were last seen in June 2020. The Transatlantic trade still remains strong, just a little short of the highs that the spot rates saw in End September- Early October.

It must be noted that China’s export figures released earlier in the week saw the export growth rate slower than in September, and imports remained muted too, this is still showing on-the-spot rates too, as Transpacific rates have been the drag on the Composite Index. Drewry’s analysts expect smaller weekly falls in spot rates in the shorter term.

For more information: container-news.com