The apple and pear season in South Africa (RSA) began a few weeks ago and Vanguard International notes there are challenges ahead. The RSA apple and pear industries are very stable, showing small yet constant growth mainly due to the replanting of new varieties with better yields.

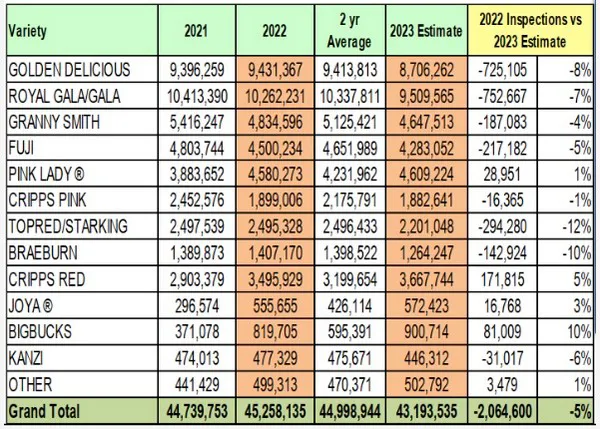

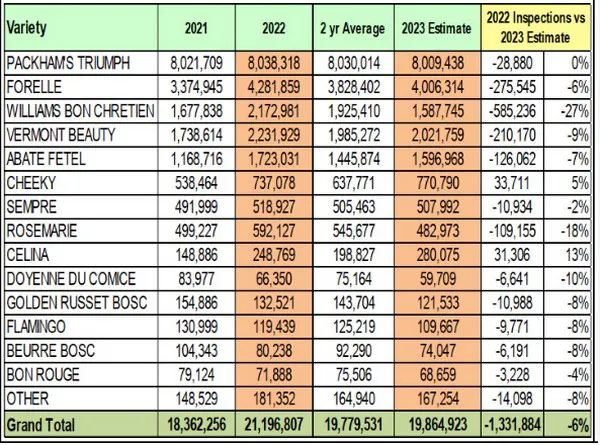

However, it is anticipated that apples and pears will experience a decline in export figures for 2023. Apple exports are expected to decrease by five percent to 43.19 million cartons and pear exports are predicted to decrease by six percent to 19.86 million cartons. Even with this projected decrease, the expected figures are marginally higher than the two-year average for pears and only slightly lower for apples.

This decline in exports can be attributed to hailstorms that occurred in late November and early December in Ceres and Langkloof. Unfortunately, Langkloof has experienced additional hailstorms in recent weeks, which may result in even lower export figures. Some of the major players in the industry speculate that the numbers should be between eight percent and 10 percent lower than last season.

Apple export estimate 2023.

Apple export estimate 2023.

For now, the market in Europe looks strong and maybe even under-supplied while Africa faces different challenges. The Nigerian currency is fluctuating and West Africa is experiencing a dollar shortage. Inflation is also a major concern in Africa with Ghana experiencing a rate of 54.1 percent. Yet, Africa remains a significant importer of apples from RSA. African countries are fond of Golden Delicious, one of South Africa’s biggest-volume apple varieties.

The initial assessment of the South African pome fruit crop notes that electrical load shedding is significantly impacting the crop’s viability. South Africa experienced only five days of load shedding in 2018, which grew to 51 days in 2022.

Pear export estimate 2023.

Pear export estimate 2023.

Goldens, Royal Galas, Flash Galas and Joya apples all started strong but the export figure up to week 9 was down 15 percent. Vanguard is +/- 10 days early but wind delays out of Cape Town are slowing exports.

The biggest market for the 2.65 million cartons of apples exported season-to-date is Africa (48 percent), FEA (35 percent) and Middle East (13 percent).

Pears

The pear harvest is also starting around 10 days earlier. Packham pears have a good start and the first offerings from Grabouw and Ceres look excellent. Although export figures on pears up to week 9 are 20 percent lower, the goal is to make up the shortfall once shipping operations resume. The Forelle pear harvest also began last week and packing of the first FEMA Forelle is imminent. The expected crop size on Forelle is around 4 million.

The biggest markets for the 3.75 million pears exported up to week 9 were the Middle East (25 percent), Europe (29 percent), Russia (19 percent) and FEA (15 percent).

For more information:

For more information:

Andrea Bava

Vanguard International USA

Tel: +1 (778) 908-1764

andrea@blitzme.ca

https://www.vanguardteam.com/en/