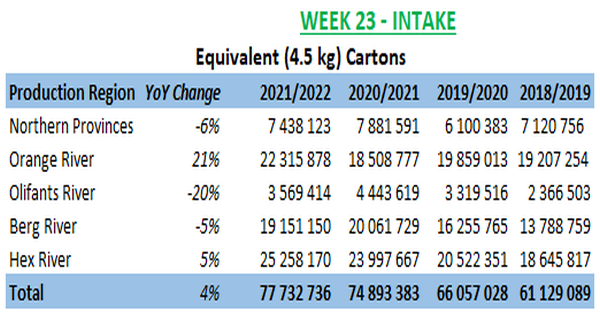

The South African Table Grape Industry (SATI) released the final numbers for the 2021/2022 table grape season, which has officially concluded, with intakes reaching a total of 77,7 million cartons (4,5kg equivalent). This is a 4% increase compared to the 2020/2021 season.

Season Summary

When comparing regional performance to the 2020/2021 season, the Orange River and Hex River regions displayed the highest volumes inspected with an increase of 21% and 5% respectively.

"We remain conscious of the challenges faced by producers as well as both the local and global challenges impacting the industry.

SATI once again commends producers for their dedication and demanding work. We continue to seek solutions to the challenges faced this season and look forward to working as a collective to mitigate future challenges.

"In relation to the Cape Town port, please be on the lookout for a joint statement issued by SATI, FPEF and Hortgro on the progress made to date. In addition, we have also received a request to deploy additional resources regarding our efforts in respect of the Cape Town port. We are now in the process of considering this, and we will keep you updated as we progress," the industry body stated in the final seasonal newsletter.

JGMF Report Back Summary

On 07 June 2022, SATI hosted a virtual Joint Grape Marketing Forum (JGMF) which was the final one for the year. The meeting provided an opportunity for all stakeholders to provide input and summarise events of the season. The main points of discussion were:

Industry Trends

Intake Volumes

Intakes have displayed an upward trend YOY. For the last 3 seasons, intakes have increased from 66,1 million cartons in 2019/2020 to 74,9 million cartons in 2021/2021 and 77,7 in 2021/2022

Plantings have displayed a downward trend, decreasing from 21 798 ha in 2019/2020 to 20 564 ha in 2021/2022.

Cultivar Production

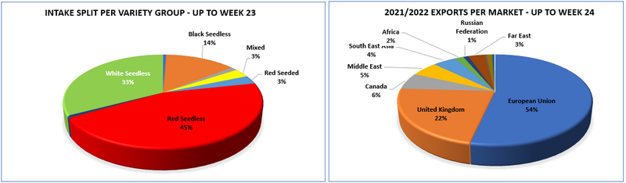

- Red seedless grapes cultivar production has decreased from 48% to 45%

- Production of black seeded grapes declined from 2% to almost 0%

- Production of black seedless grapes has increased from 13% to 14%

- White seedless grapes production increased from 30% to 33%

Markets & Market Share

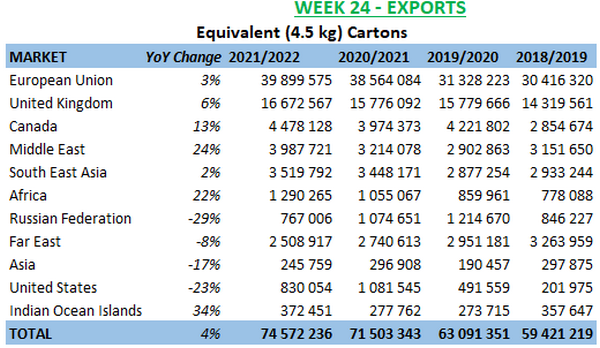

In comparison to 2018/2019, the following shifts in export market proportions have been noted:

- Exports to the EU have increased from 51% to 53%

- Exports to Canada have increased from 5% to 6%

- Exports to the UK have decreased from 24% to 22%

- Exports to the Far East have decreased from 6% to 4%

When considering the international landscape, exports from Peru and Chile have been growing steadily. This increased supply of grapes remains a threat to South Africa’s exports, and we need to track this to stay abreast of this matter, especially during specific windows.

Regional & Breeder Feedback

Collective feedback centered on the following 3 key themes:

Cultivar Selection

Discussions included that some older cultivars are no longer in favour in certain markets, retailers are becoming more aware of cultivar performance, and that there is a real risk of cultivars becoming unwanted due to quality issues and the inherent ability of the grape. Each producer, together with his/her exporter needs to take an informed decision on available markets and their specific requirements.

Crop Load

Producers and cultivar owners were very vocal regarding the risks associated with high crop loads and are being careful to avoid adverse effects such as insufficient colour development, low growth and post-storage quality issues. Cultivar owners cautioned that high crop loads can lead to longer ripening periods and colour development inconsistency due to unequal sugar accumulation. It is therefore important to understand the micro-climate and economic situation of each farm to achieve the fine balance between economic viability and crop load.

Optimum Harvest Maturity

Stakeholders agreed that higher sugar/acid ratios equate to a higher risk of quality issues. Therefore, a continuous need for up-to-stage cultivar specific optimum maturity dates under various conditions exists.

Peak Weeks & Logistics

- Data from collective fruit commodities utilised in discussions with Transnet, indicates ship loads of typically >2 500 containers between weeks 1 and 10 (pome, stone & table grapes)

- From a table grape industry perspective, it is important to continue to stress the importance of week's 49 to 11, which display high table grape exports, with >1 000 containers per week (table grapes only)

- During weeks 3 to 10 these volumes increase and table grape exports peak, with >1500 containers per week (table grapes only)

- The logistics challenges experienced this season resulted in longer travel times to most markets

- Together with Hortgro and FPEF, SATI continues collaboration with Transnet to address challenges at the Cape Town Port. Key action points include:

- The optimal usage and expansion of cranes,

- The deployment of extra teams (progress has already been made),

- The increased use and refinement of night shift/runs - which will require industry commitment,

- Provision of additional mooring equipment as part of capital expenditure that appears to be progressing well,

- Regular equipment maintenance - procurement plans have already been shared with us in this regard and we are making progress and

- Working on Belcon (inland container terminal) costs and operations to feed containers directly to shipside seamlessly/cost-effectively.

For more information:

AJ Griesel

South African Table Grape Industry

Tel: +27 21 863 0366

www.satgi.co.za