Mission Produce was founded in 1983, at a time when avocado consumption rates were low. Annual U.S. consumption was fewer than two pounds per person, and little to no data existed for European consumption. Back then, there were still green skins on the market, but there was also a rising awareness of the Hass variety because of its versatile flavor profile. “In the past four decades, much has evolved in the global produce industry, in the avocado category, and in our company,” says Steve Barnard, CEO & Founder of Mission Produce.

“When I think back to Mission’s early days, we could not have predicted all the regions around the world we would be in today,” he shared. Nonetheless, Mission has been international from the very beginning. In the first year, Barnard met with a large distributor in Japan and asked, “How do we get all your business?” They said, “Don’t ever let us run out. Give us a year-round supply.”

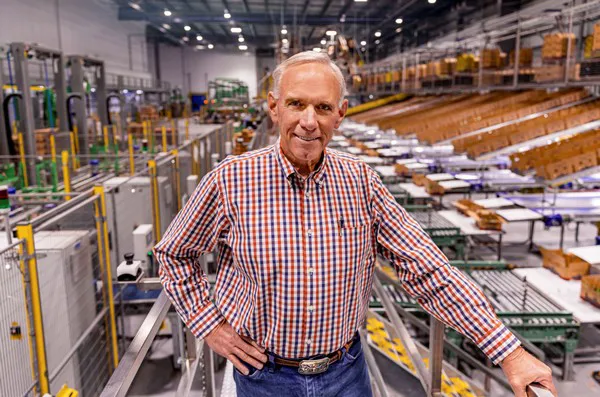

Steve Barnard, CEO & Founder of Mission Produce, in front of the lug palletization and packing lines in North America’s most advanced avocado packing facility, located in Oxnard, California.

Steve Barnard, CEO & Founder of Mission Produce, in front of the lug palletization and packing lines in North America’s most advanced avocado packing facility, located in Oxnard, California.

Expansion outside the U.S.

“Therefore, we established operations in Mexico in 1985 to provide fruit during California’s off-season.” Soon after, the company began distributing to other customers in Asia, Europe, and Canada. “We have remained at the forefront of emerging markets ever since.” With global avocado demand continuing to outpace global supply, Mission continues to look for sourcing opportunities to procure additional volume for the market. In securing supplies, we work with a global network of growing partners to source from multiple origins year-round,” Barnard commented.

This sourcing strategy has taken Mission into premium growing regions around the world including California, Mexico, Guatemala, the Dominican Republic, Colombia, Peru, Ecuador, Brazil, Chile, Israel, Kenya, and South Africa. Outside the U.S., Mission owns farms in Peru, Colombia, and South Africa. “Vertical integration gives us greater control over our own production and the ability to benefit from additional availability of fruit to help mitigate supply gaps and ensure reliability of supply for customers around the world.”

Ripe program

Early on in the global expansion journey, Mission saw an opportunity to address untapped demand for ripe avocados. “We developed avocado-specific ripening technology and built a ripening center in Oxnard, California. We piloted the first ripe program with Ralphs Grocery in 2000 and saw a 300 percent increase in their sales in the first year – it was game on!” The ‘ripe revolution’ was born, launching the global avocado boom. Ever since, per capita consumption has grown from less than two pounds per capita to over 8.5 pounds in the U.S. in 2021. In addition, the globalization of avocado supply has grown in Mexico, Peru, the Dominican Republic, and Colombia. “Our ripe program was so successful that we eventually opened eleven more state-of-the-art ripening centers – one of which is strategically located in Breda, the Netherlands,” Barnard shared.

Mission’s avocado-specific ripe rooms in the company's state-of-the-art forward distribution center in Breda, Netherlands.

Mission’s avocado-specific ripe rooms in the company's state-of-the-art forward distribution center in Breda, Netherlands.

Europe as a substantial market

Although many people associate the global avocado boom with Mexico, South and Central America, and the U.S., the industry recognizes Europe as a substantial market due to its growing consumption rates and potential to absorb increasing volumes. In 2013, when Mission built its facility in Breda, annual avocado consumption in Europe was under 100,000 tons. In 2020, consumption rose to 670,000 tons, and according to preliminary figures, avocado consumption in the EU and the UK increased by about 8 percent in 2021.

As the ripe revolution took off, Mission realized the need for more fruit during the May-September window. “So, in 2012, we started developing 5,000 hectares in Peru to fill the need.” The growth potential for avocados in Europe is fueled by the market’s access to more fruit. “As the largest global distributor of avocados, we are uniquely positioned to help supply the market’s increasing demand.”

Expansion into mangos

“Our success in managing record volumes of avocados led us to leverage our global network, state-of-the-art infrastructure, and ripening capabilities to add an additional commodity to our portfolio– mangos,” said Barnard. "One year in, the company’s mango program continues to expand, and we look forward to continued growth in the category."

For more information:

For more information:

Jenna Aguilera

Mission Produce

[email protected]

www.missionproduce.com