The focus on high-yield/flavor varieties. The effect of inflation. Protecting the quality of grapes.

These are just a few of the topics that came up on last Friday’s Grape Quality Summit, hosted by Hazel Technologies.

Anne-Marie Roerink 210 Analytics LLC started the summit off with a presentation on the table grape’s U.S. retail performance over the last year. She noted that compared to 2019, before the pandemic began, fruit and vegetable sales continue to do extremely well. “Grapes are the third largest seller in fruit and a powerhouse in their own right with sales of $3.6 billion--that was up 6.9 percent over the year before,” she says. However she does note that with grapes, while dollars are up almost over seven per cent over the year before, units and volume are down 2.8 and 2.6 percent.

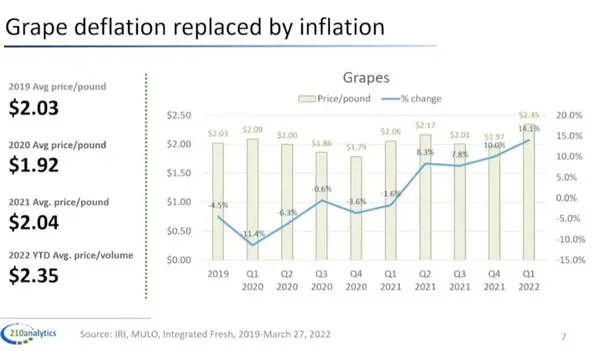

“People are buying grapes roughly the same number of times--about 10x/year. They’re spending more per trip and that has everything to do with that inflation,” Roerink says, adding that in total, people are also spending more per buyer compared to last year. “But what is different is the number of households buying grapes at retail in the last year. That was down 0.4 percent.”

She also notes that looking at dollars versus volume, it showed huge demand for grapes during the first year of the pandemic. “However prices were down. So even though we sold way more lbs., we just weren’t able to keep up with dollars at retail,” Roerink says. However in 2021, that flipped and dollar growth was more aggressive, even though volume dropped off. “Inflation is really starting to hit grapes and that has a lot to do with the pressure we’re seeing in units and volume as well,” she says.

A drop in promotions

She also notes that in the last year there have been fewer grape promotions. “That’s important because grapes have always been a highly promoted category,” she says. “Total pounds sold while on some kind of promotion sits at 35 percent for total fruit and almost 50 percent for grapes. Compare that to pre-pandemic, it’s down 19 percent from about 60 percent during normal years. Those promotions and visibility that grapes have tends to drive household engagement,” she says.

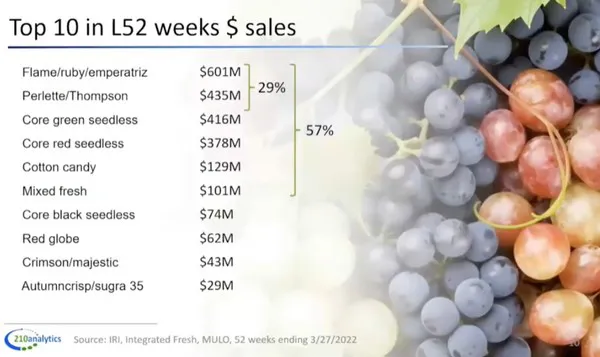

Varieties were also touched on in the session and Roerink noted that flame/ruby/emperatriz and Perlette/Thompson represent almost 30 percent of sales. Those, along with core green seedless, core red seedless, Cotton Candy grapes and mixed fresh represent almost 60 percent of sales. However growth percentages in dollars in some of the smaller varieties are seeing double-digit growth.

On price per lb., the number one seller, flame/ruby, is averaging a price per lb. of $2.10. “Compare that to a Cotton Candy, it’s $4.27. So you have to sell way fewer lbs. of Cotton Candy grapes to arrive at the same number of dollars in total,” Roerink says, noting that consumers are excited about having something new in grapes in the marketplace.

Organics is also seeing significant growth and Roerink says 6.4 percent of total dollars are organic grapes, a number that’s up 4.6 percent from 2020. “That’s not just inflation--we’re seeing above average growth in dollars, units and volume there,” she says.

Grape sales opportunities

And in terms of hot growth sales applications, charcuterie is “red hot.” “Grapes need to play a big role there from complementing the meats and cheeses but also from a color perspective,” says Roerink. “We also see on-the-go snacking being back and convenience stores are in the mix too. So we still have a lot of hot growth areas for grapes.”

Next up a grape panel looked at growing developments being seen in grape growing today. Jasmine Vineyard’s operations and food safety manager Luis Katsurayama says it is working on implementing the minimum wage increase on labor and the 40 hour work week. “These two things have the industry going into overdrive trying to figure out how to adapt to changes in the California environment,” he says.

Clockwise from top left: Luis Katsurayama, Pat Flynn and Nico Tomicic.

Clockwise from top left: Luis Katsurayama, Pat Flynn and Nico Tomicic.

In turn, it’s also influencing varieties being grown. “I think the low-yield varieties we’re accustomed to eating--the Flames, Thompsons--are going to disappear from supermarkets. This business environment is forcing us to pull out low yield varieties whether they’re still popular or not. They’re out of our economic reach as a producer. We have to focus on the high yield varieties or the better selling products,” says Katsurayama.

Supply chain woes

The state of the supply chain also continues to concern growers. “The logistics issue is not getting any easier. We don’t foresee it getting any better this summer. So we’re trying to figure out how to supply the countries with product and air has been its only option so far and limited our economic reach,” says Katsurayama.

Meanwhile Hazel Technologies’ business development manager–agtech, Nico Tomicic, notes changes continuing to be seen in the industry in California. “Quality is going to be one of the most important factors--yield too--for growers. I believe the good growers will be able to export overseas and it’s going to be a great market for them,” he says. He also noted that some growers using Hazel Technologies’ product to help ensure the fruit quality is helping keep the late market from Chile going on grapes as well.

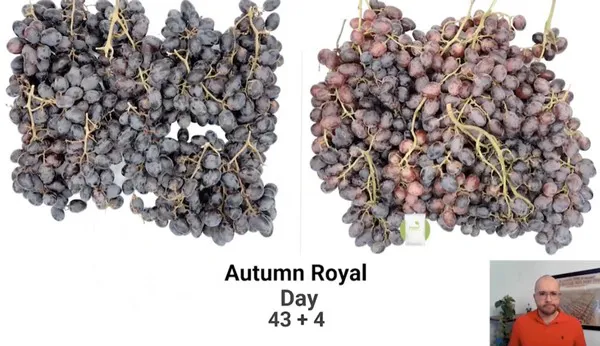

Mario Cervantes, director of business development–agtech at Hazel Technologies discussed trials focused on postharvest technology--seen here on Autumn Royal grapes.

Mario Cervantes, director of business development–agtech at Hazel Technologies discussed trials focused on postharvest technology--seen here on Autumn Royal grapes.

Looking ahead at California’s season, Katsurayama says that last year was an unusually low-yield year for the state’s growers. “And this year is different already. We believe yields are going to be much higher than last year,” he says. He echoes Tomicic’s sentiment that given there will be a lot of fruit on the market, the quality of the grapes will determine the producers who come out on top.

At the same time, California continues to look at innovations to help its production such as Hazel Tech’s products to ensure quality but also mechanization. “That’s going to be key for the future for California producers given the business environment,” Katsurayama says. “Labor is becoming scarce and very expensive so we’re looking for options to keep up with the industry. But we’re also investing in human capital--we’ll need skilled labor so we’re working with our labor now to have them try and adapt to the new technologies.”

For more information:

For more information:

Hazel Technologies, Inc.

[email protected]

https://www.hazeltechnologies.com/