The first early exports figures of Argentinian lemons show -29.21% less fruit is certified compared to the same time in 2021, pointing to a clear delay in the beginning of the lemon campaign. Although there is an 88% increase to Europe, the stats show a drop of -25% in exports to Russia, -66% less to the USA, and -72% less to other destinations up to week 17 compared to the same time last season. Early lemon exports to Latin America increased by 42%. These first export statistics were released by the Citrus Growers Association of the Argentine Northwest (Acnoa), based in Tucuman.

Paula Rovella, from Acnoa provides a further breakdown of Argentina’s early lemon exports for the 2022/2023 campaign.

Lemon: Until week 17 (to all markets), -29.21% less fruit (lemon) is certified with respect to 2021, clearly there is a delay in the beginning of the lemon campaign.

Markets that grew exports to W17 (2021 vs 2022):

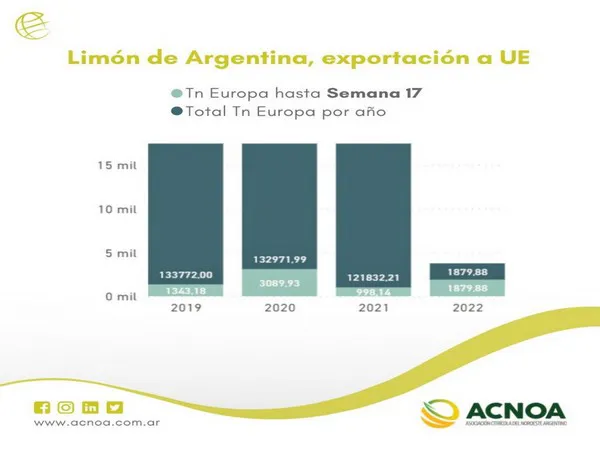

Europe: It grew by 88% compared to 2021 (atypical variation, detailed later), however, if we average the last 3 campaigns prior to the latter (2021), we observe a fall of 37.4% compared to the current season. It is worth clarifying that in 2021 the European market reopened the exports of our lemons from May 1st. Therefore we can say that our exports were delayed to this market.

Spain resumed shipments, after the interruption due to the rains. The current volumes are not abundant, as there is the transition between the last Finos to the first of Verna. The quality of the Fino is heterogeneous (uneven) due to the rains and its advanced maturity. The Verna starts with good quality, although with larger sizes than expected. Lower supply, versus stable demand, is beneficial. Availability is lower, but there is no shortage. A large part of the stocks were liquidated. The RANGE of FOT prices was extended. The Primofiore that maintain quality improved their price, but a part of the offer is marketed at low prices given their weak condition. The Primofiore campaign will end quickly due to the lack of quality. Verna will advance and there will be supply of this variety for the next 7-8 weeks (Topinfo).

Latin America (Brazil, Mexico, Paraguay, Uruguay): An important growth of 42% stands out to these countries with respect to 2021.

The following destinations decreased:

Russia: - 25% less than in 2021. It is due to the uncertainty that there was at the beginning of the Russia-Ukraine war, little by little the loads are normalizing, and the volumes are increasing.

Note that from March 28 to October 30, 2022, the Eurasian Economic Commission reduced import duties for fresh citrus fruit to 0% entering any of the 5 member states of the organization (Russian Federation, Armenia, Belarus, Kyrgyzstan and Kazakhstan). Until now the import duty for lemons was 5% with a minimum price of 0.015 euros per kg for lemons, mandarins and grapefruits and 0.017 euros per kg for oranges.

United States: -66% less than in 2021. Remember that in 2021 shipments were higher at this time because the European market was still closed (opened on May 1). We estimate that the loads will gradually normalize.

Other Destinations: -72% less than in 2021.

China & Hong Kong: In 2021 to date they had been exporting 204 tons. This year shipments to this market have not yet begun, but similar values are estimated for this year.

For more information:

Paula Rovella

Acnoa

Tel: +54 (381) 231-9339

Email: info@acnoa.com.ar

https://acnoa.com.ar