The global orange juice market is seeing the lowest inventories in five years, with diminishing output from Brazil and Florida. In normal times, this would push prices steadily higher. However, long-term demand headwinds and a possible mild recovery in Brazilian juice output in 2022/23 could limit price gains this year.

Supply issues intensified in the last year

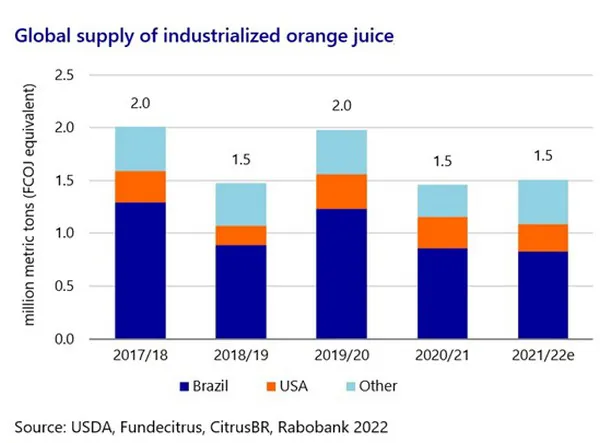

According to a recent Rabobank report, the global supply of industrialized orange juice declined to around 1.5m metric tons frozen concentrated orange juice (FCOJ) equivalent for both the 2020/21 and 2021/22 seasons, close to the lowest levels seen over the past ten years.

But there could be a moderate bounceback in 2022/23 if weather conditions remain favorable in Brazil. However, the long-term trend suggests that overall production will continue diminishing.

Meanwhile, Florida production also continues to decline. The current harvest will barely surpass 40m boxes, around a third of the volume produced just 10 years ago. Reduced investments and rising production costs mean that it continues to be an uphill battle. Mexico’s production has recovered this season but, in the longer term, it is unlikely to grow much more, and the market expects around 200,000 tons (FCOJ equivalent) of output in the coming years.

The category is underperforming in key markets

At the retail level, western orange juice markets saw rising sales during the pandemic. However, the boost was temporary rather than a permanent reversal of the long-term trend of decreasing consumption in developed markets.

“Orange juice is underperforming markedly in recent years compared to other categories. In the main markets of the US, the EU, and China, other categories like bottled water and even carbonated beverages have outperformed the 100% juice segment, even considering the short-term positive boost in consumption created by the pandemic,” explains Andrés Padilla, Senior Analyst – Beverages at Rabobank.

Low inventories are sustaining global prices

Global inventories of Brazilian orange juice are expected to stand at just 126,000 metric tons by the end of June 2022, compared to an average of 298,000 metric tons over the past five years. This means that processors have less margin to use previous inventories for the blending of products.

Supply chains are also more vulnerable to renewed problems in the Brazilian orange harvest. “For now, the market is trying to find a balance around current price levels, but new weather problems during the Brazilian dry season could cause prices to rapidly move higher than the current listed FCOJ levels of USD 2,100 per metric ton in Rotterdam,” according to Padilla.

Orange juice is showing resilience to geopolitical and macroeconomic shocks

For now, the sector is proving resilient to geopolitical and external shocks. However, consumption in emerging markets could weaken due to inflation of other food-related products. Even some consumers in developed markets could temporarily reduce their consumption of premium not-from-concentrate juice.

For more information:

Rabobank press office

[email protected]

Tel.: +31 30 216 2758