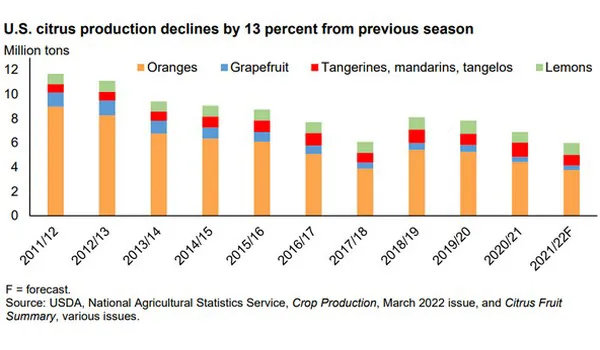

The 2021/22 U.S. citrus crop is forecast to be 6 million tons, down 13 percent from the final output for the 2020/21 season. Declines in overall production are due to smaller orange and grapefruit crops in California, Florida, and Texas, and smaller mandarin crops in California and Florida.

All orange production in the State of California is expected to decline by 5 percent, split between 4 percent reduction in non-Valencia orange production (navel and early/mid-season varieties) and a 9 percent reduction in Valencia oranges from last season. The Florida all orange supply forecast dropped by 5 percent from the February 2022 forecast and is expected to be 22 percent below last season. Orange supply is expected to be below levels of 2017/18 when Hurricane Irma hit Florida. Decreased production of oranges, grapefruit, and tangerines are expected to result in increased imports and higher prices compared to last year.

Price Outlook

Fresh Fruit Producer Price Index Increases at Start of 2022 The February 2022 fresh fruit producer price index (PPI) was 172.06 (1982 =100), up 4.5 percent from January 2022 and up 13.3 percent from February 2021. The February PPI increased for two consecutive years. Grower prices for fresh citrus, apples, and grapes increased in the beginning of the year driving up the PPI.

USDA, Agricultural Marketing Service, U.S. Mexico Canada Agreement Seasonal Perishable Products Weekly Update continues to report weather events, transportation issues, and increasing input costs along the supply chain such as fuel, containers, labor, and other costs.

Click here to view the full report.

Source: ers.usda.gov