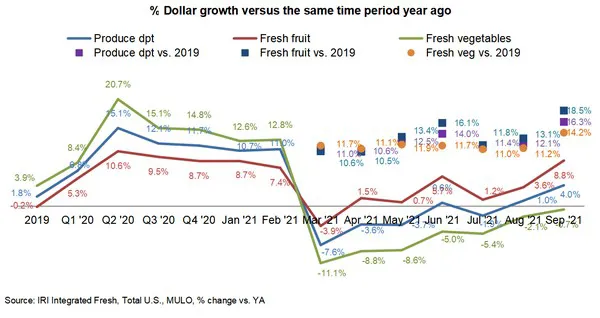

September continued where August left off. “The multi-month normalization of consumption and grocery shopping patterns came to a halt in August hand-in-hand with an uptick in COVID-19 case counts,” said Parker, team lead fresh with IRI. “In September, the IRI survey of primary grocery shoppers found an elevated share for at-home meal preparation, at 79 percent, compared to the July low of 76.6 percent.”

The survey found that more people returned to buying groceries online. During the height of the pandemic, as many as 20 percent of trips were online. This dropped to 11 percent in July and by September, the share reached 14 percent.

Between changes in consumer consumption/buying patterns, high inflation and severe supply chain disruptions, fresh produce retailing remains in flux. IRI, 210 Analytics and the Produce Marketing Association (PMA) teamed up since March 2020 to document the changing marketplace and its impact on fresh produce sales.

The first nine months of 2021 brought $504 billion in food and beverage sales. September marks the return to year-over-year sales growth in dollars, up 0.1 percent.

The stellar 2020 performance for fresh produce was secured by better trip conversion and an increase in spend per trip. In 2021, engagement remained high with small decreases.

Food prices in retail and restaurant settings are seeing significant inflation. “Consumers are noticing their groceries are more expensive,” said Joe Watson, VP of membership and engagement for PMA. “But one statistic from the USDA Economic Research Service (ERS) notes Americans spent 7.8 percent less on food in 2020 than the year before as a result of eating more meals at home versus eating out.”

Year-to-date, prices for total fresh produce are about 6 percent higher than last year. Inflation for fruit is at +7.6 percent year-to-date through September 26. Fruit prices during September 2021 were 8.9 percent higher than in September 2020.

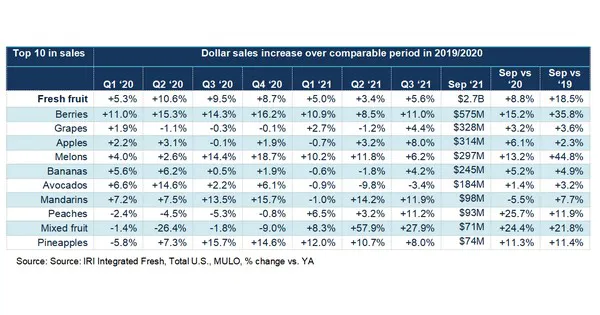

Comparing September pound sales versus the pre-pandemic 2019 normal is impressive. Free and clear of the effect of inflation, it shows that U.S. retailers sold 11.4 percent more pounds of fruit and 7.7 percent more pounds of vegetables in September 2021 than the same month in 2019. “We had quite a few changes in the top 10 in absolute dollars for fruit,” said Parker. “While berries remained number one in sales, grapes and apples became the new number two and three, bumping melons down.”

“We had quite a few changes in the top 10 in absolute dollars for fruit,” said Parker. “While berries remained number one in sales, grapes and apples became the new number two and three, bumping melons down.”

“Vegetables generated $2.6 billion in September — rapidly approaching 2020 levels. But across categories, the performance is more mixed. Packaged salads sales have been terrific since the onset of the pandemic, but other areas including potatoes, peppers and mushrooms trailed behind last year’s numbers,” said Watson.

The next report covering October will be released in mid-November.

Please click here for the full report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

[email protected]

www.210analytics.com