Helmut Hübsch of GfK SE presented current figures and forecasts for 2021 at DOGK (Deutsche Obst & Gemüse Kongress 2021). While private consumption rose sharply in 2020 due to the lockdown, out-of-home consumption dropped sharply. For example, as a share of total sales, out-of-home consumption was still 40% in 2019, while last year it was only 33%.

In terms of price level, FMCG excluding fresh products increased by 2.9%. In fresh products, the price level increased disproportionately by about 1.9% compared to the previous year, when there was a rate of change of 5.3%.

Helmut Hübsch at DOGK 2021

Loser: Berries - winner: Grapes

Regarding fresh fruit, the price levels have been slightly stagnant since 2019. Hübsch described berries as the "big losers" as they are down this year due to the cold and wet weather, selling about 7% less. Stone fruit also suffered a drop of about 7% due to a lack of volume. Overall, however, the reduction in sales was not too noticeable.

As a replacement and substitute product, grapes were able to establish themselves as the "winner" this year. Here there were increases of around 17%. Citrus also experienced significant growth last year of just under 10%; people have been eating healthier.

At hypermarkets, sales growth in fruit has been strong, while it has been stagnant at discounters. In general, discounters are weakening against large-scale and full-range stores. Due to the weather, farm markets and above all weekly markets were rather left behind this year.

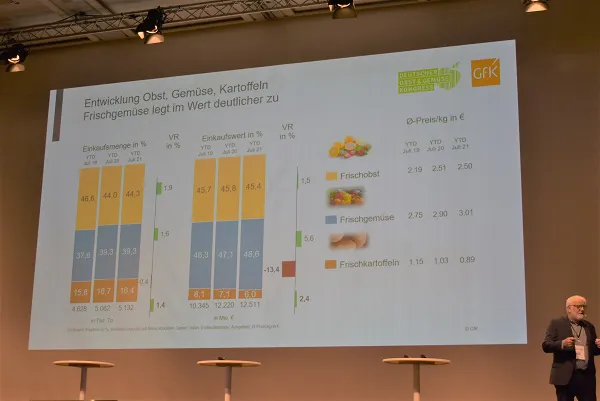

Overall high value growth for fresh vegetables

Fresh vegetables had higher overall growth rates in value. Fruit vegetables such as tomatoes grew in value by 6%, peppers by 8%, and carrots/carrots have a real price premium from €3.60 to €3.80, which can also be attributed to their organic quality. In the discounter, vegetables are increasing in value, but not as much as in the full-range retailer.

"Sustainability doesn't just mean global warming"

Hübsch emphasizes that sustainability is not just focused on the climate aspect but also includes the issues of biodiversity, environmental/ocean pollution, and land use in particular. But nutrition naturally also plays a special role, for example, in vegetarian products, imitation soy in milk, glass packaging in beverages, and the organic sector as a whole.

In the case of organic fruit, two varieties are particularly important: bananas, with a share of 16.6%, and citrus fruits, with a share of 10.9%. In organic vegetables, herbs are again at 28.4% and carrots at 24.2%.

Organic goods have created a large market potential, yet the share of organic fruit from Germany is just 1%. Large parts are still imported from abroad. Organic vegetables in winter also tend to come from abroad. According to Hübsch, the market needs to be supplied with German organic goods even more.

For more information:

Helmut Hübsch

GfK SE

Sophie-Germain-Straße 3-5

90443 Nürnberg

Tel: +49 911 395-0