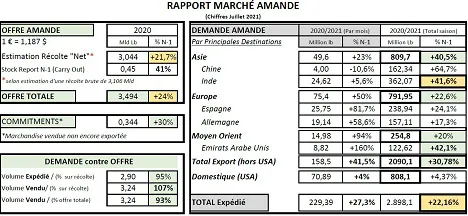

The 2020/2021 campaign officially ended on July 31st, 2021. The latest publications of the almond board allow us to draw a clear conclusion. With 11 new monthly shipping records reported over the past 12 months, Californian producers have succeeded not only in selling a record harvest (3.24 billion pounds sold of the 3.04 netto harvest), but also in shipping nearly the entire harvest (2.89 billion pounds, i.e. 95%), in spite of the hellish logistical and sanitary context (lockdowns, work restrictions, lack of containers…).

The American demand remained high (808 million pounds; 4.37% growth), but it is the export market, thanks to the recent and very accommodating pricing policy, that has been the true engine for success (+31%; +492 million pounds vs. N-1), with the infallible support from Europe (+23%, +146 million pounds vs. N-1), the exceptional dynamism of India (+41.6%; +107 million pounds N-1) and the notable return of China into the game (+64.7%; +66 million pounds vs. N-1).

What are the prospects for this new 2021/2022 season?

The TNT estimates for the 2021 harvest, initially considered pessimistic but recently confirmed by the objective “official” estimates of July (2.8 billion pounds), quickly changed the market this summer. Indeed, prices have increased by more than 25% in the past 2 months in response to the “low” harvest of 2.8 billion that was announced, lower indeed than the volume shipped during the 2020/2021 campaign (2.89 billion).

The high demand from India for almonds in shell, the shipping difficulties, and the fears regarding the consequences of the current drought are among the factors that were still recently weighing on prices. However, we have observed a slight decrease recently, and the willingness of Americans to accept lower bids, probably echoing the current decrease in new crop forward sales that are lower than at the same time last year (-36%), on a market which is already covered for the short and medium term. The first publications on sales and shipments for this new season will be published in a few days, which should bring a little more clarity.

Note that the Spanish harvest is announced to be excellent this year (120 to 140,000 tons), especially thanks to the new sweet “Guara Type” varieties entering in production, and grown “the American way” with optimized irrigation and densification per hectare. The first offers we receive are very attractive compared to the Californian quality (from -0.50 to 1€/kg [0.59 to 1.17 USD/kg] depending on the calibers and varieties). It will certainly promote this origin for the new 2021/2022 campaign.

For more information:

KANOPEE Sarl

28 rue Gabriel Lippmann

L-1943 Luxembourg

https://kanopee.lu/