“They came via necessity but they’re staying for convenience, "says Jonna Parker, principal of IRI Center for Excellence, on what helped fuel online shopping over the past 18 months. Parker was part of the most recent PMA Virtual Town Hall on Online Insights and Evolving Shopper Sentiment, and shared her thoughts on how to make consumers and their relationship with online grocery shopping even better.

IRI, who recently conducted a survey of more than 3,000 participants in conjunction with the PMA, opened the session touching on the fact that while it’s generally known that the pandemic accelerated consumers’ interest in online shopping, that high level of interest seems to be sticking around. “Almost eight out of 10 consumers have bought groceries online in the last month. And for 14 of percent of respondents, that’s their primary way of buying groceries,” says Parker.

Parker goes on to note that six out of 10 online fresh food online sales originate from a retailer (for either pick up or retailer-direct delivery), a statistic that’s held fairly consistent. “With online shopping, it’s not about a faceless dotcom. It’s about working with our retail partners and companies like Instacart to bridge this gap.”

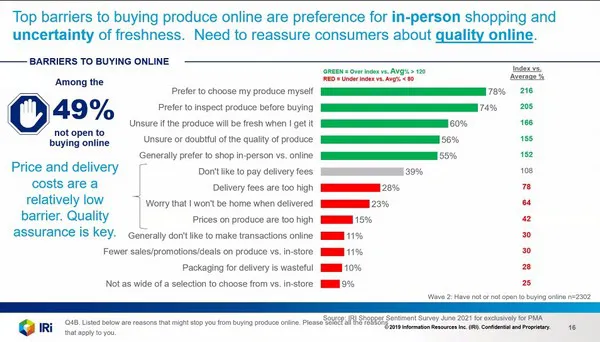

However she does note the gap in shoppers buying produce online. “Almost 3/4 of produce shoppers have not purchased produce online. There are a lot of people who are buying groceries online who haven’t felt comfortable buying produce yet,” she says.

There’s a perception that consumers feel that online isn’t a place to get deals and promotions. “But it’s also about choice and quality,” says Parker. The barrier, she notes, is that consumers aren’t sure they’re getting the freshest, most optimal produce selected for them. “It’s about trust,” she says.

Online produce purchasing also tends to run in commodity circles. “Buyers who are more likely to have bought produce online are more likely to be buyers of categories such as avocados, apples, berries and melons. People who are less likely to purchase produce online buy fresh cut produce, but also grapes, oranges and tomatoes. Grapes and oranges tend to have older [survey] respondents but tomatoes should be a slam dunk for selling online given how fresh and packaged options there are,” Parker says.

However better search functions on online shopping sites could be in order. “When searching for citrus, mushrooms and grapes, those all have wide varieties with premium options and commodity versions,” she says. “And searching grapes for example will give you a hodgepodge of products including grape jam. Convenience is the motivator to shop online. But value and quality, especially around selection and options, need to be addressed.”

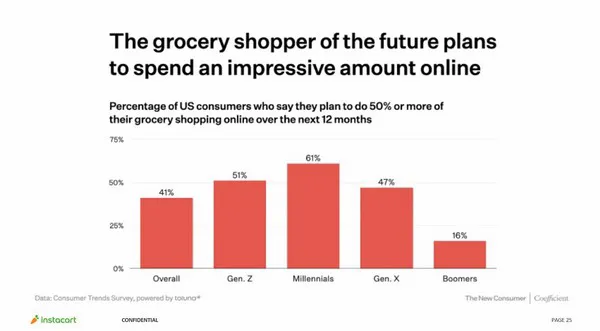

Also on the panel was Instacart’s Kyle McWhirter, director of sales--emerging, who also noted that online shopping is hailed to be a “sticky” trend that will likely stay out of all the trends that emerged via the pandemic. “It was fueled by necessity. But now that shoppers have become accustomed to this, they prefer it to the brick and mortar experience,” he says. This includes future generations. “As more consumers age into a grocery shopping demographic, this is another tailwind to this experience,” he says.

McWhirter also notes that with produce purchases, produce shopping on Instacart is now an established behaviour. “Over 50 percent of Instacart shoppers are purchasing vegetables 1x/month in their basket. And 31-32 percent of fruits are being included. But there’s still opportunity.” He also adds that produce is the fifth largest category that Instacart sees in total sales volume and is the fastest growing of those top five categories.

But to continue to build on those online produce buying gains, rethinking the grocery space is in order. “With online shopping, a lot of the physical constraints of a store go away. There’s not really an aisle anymore. The way consumers find products is via search, first and foremost,” McWhirter says. He also adds that the reorder factor is also key. “The more established consumers are on our platform, the greater the percentage of reorder becomes. Once you’ve been able to get into a basket, your brand will continue surfacing in that shopping experience.”

Ultimately, McWhirter says brands need to work backwards from the consumer experience. “The single most important thing you can do as a brand is to make sure you’re discovered. If the customer can’t find you, they’re not going to be buying you. Merchandising is completely different in a digital format,” he says.

Following this, Frances Dillard, vice-president, brand and product marketing for Driscoll’s, weighed in with a brand’s experience with online shopping. “For a lot of folks in the produce industry, this concept of online shopping is a bit intimidating. Where do you begin?” Dillard says.

From Driscoll’s experiences though, Dillard noted that one difference between marketing in brick and mortar stores versus digital spaces was how nimble online marketing proved to be. “Digital allows you to test and learn and pivot quite quickly. When you see results and unlock what works for you, that’s where you get speed and momentum,” she says. “Data drives the results with online shopping and that can help you determine what’s working in the converting new shoppers and what’s not.”

Dillard encourages brands to embrace online shopping now to get ready for the future. “If your company or brand isn’t talking about the next generation and things like “first clicks” are not part of your language, this purchasing behaviour is here to stay. You have to be fearless in learning about this,” she says.

Dillard encourages brands to embrace online shopping now to get ready for the future. “If your company or brand isn’t talking about the next generation and things like “first clicks” are not part of your language, this purchasing behaviour is here to stay. You have to be fearless in learning about this,” she says.

In fact, the best place to start might be with retailers where brands are having success already. “In some ways it’s harder to convert new users than to figure out who your existing shoppers are and how they’re changing their shopping,” Dillard says.